As a first time mom, I remember the overwhelm associated with all of the financials. Not only are you worried about buying all the baby things, but you’re also supposed to look towards the future. The future and well being of this tiny human depends on you and the choices you make for them. I don’t know about you, but as a young 23 year old I did NOT feel grown up enough for that kind of responsibility. My brain kinda shuts off when it comes to finances, so I definitely was one of those first time moms who needed help with figuring out my hospital bills.

Related: Non-Baby Related Third Trimester Checklist

I’m not sure there’s a quick and painless way to figure out finances (short of making someone else do it for you), but I believe lists can help. So I’ve put one below – a sort of checklist of things you need to go through as you’re working through understanding those hospital bills. I tend to be thorough, so I’ve included some extra financial considerations you need to address once you’re a parent.

First Time Parent Finance Checklist

Preparing for the Hospital Stay

Research and understand insurance coverage

- Contact the insurance provider for details

- Verify coverage for prenatal care, delivery, and postnatal care

- Research and decide what kind of delivery you’d like to have taking finances into consideration (birthing center, hospital, home birth)

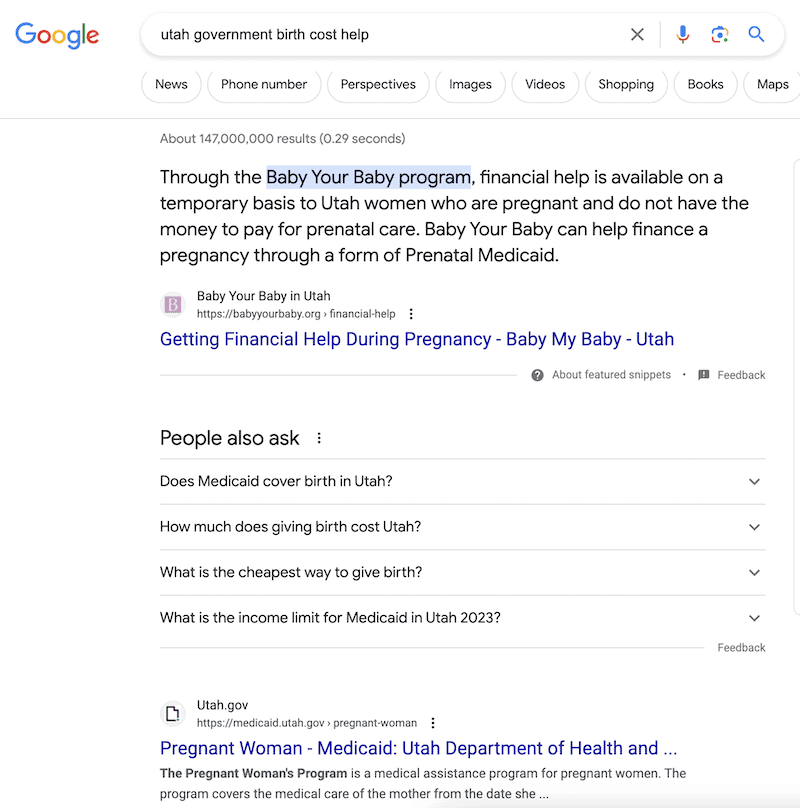

- Explore government assistance programs (optional)

- Investigate Medicaid or other state-specific programs to determine eligibility and application process (optional)

Communicating with Healthcare Providers

- Discuss financial concerns with healthcare providers

- Ask about payment plans or discounts

- Inquire about potential financial assistance programs offered by the hospital/birthing center

- Request a detailed estimate, seeking clarification on itemized charges if needed

Budgeting and Financial Planning

- Estimate out-of-pocket costs based on insurance coverage

- Consider additional expenses like medications, postnatal care, etc.

- Create a budget for anticipated medical expenses

- Set up a savings plan, allocating a portion of income for healthcare expenses

- Explore Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) (SUPER valuable for us)

Post-Delivery Financial Steps

- Promptly review and reconcile hospital bills

- Ensure accuracy and address any discrepancies (because there’s usually at least one)

- Make sure you get payment confirmation number for every payment made

- Explore postnatal financial assistance options (especially ones for new mothers – these are often location based)

- Seek support from community organizations or non-profits

Long-Term Financial Planning

- Explore life insurance and disability insurance

- Evaluate the financial impact of expanding the family in the future

- Build/maintain an emergency fund and dictate what constitutes an emergency

- Create a budget and revisit it every 6 months (or so)

Insurance Coverage

First, I want to mention that if you’re NOT currently insured but you or your partner’s place of work offer insurance – you may be in luck (at least at the time of birth). Remember with health insurance a “qualifying life event” can make you eligible for a special enrollment period. Definitely check with your (or your partners) employer and/or the marketplace to see if/when you could qualify. Here’s more information about a QLE (qualifying life event) as it pertains to health insurance.

Back to it. Researching and understanding insurance coverage is a crucial step for first-time moms preparing for childbirth and the associated hospital bills. The process will feel daunting, but I promise it gets easier.

Related: Third Trimester Checklist

To begin, contact your insurance provider well in advance of the expected due date. Keep in mind that coverage may slightly change at the beginning of a calendar year, so make sure you double check your information if a new year rolls over. Obtain a copy of your insurance policy and review the sections that pertain to maternity care, prenatal visits, delivery, and postnatal care. Pay close attention to details such as deductibles, co-payments, and co-insurance rates, as these will directly impact your out-of-pocket expenses.

Here’s a list of things you’ll need to clarify with your insurance company

- Ask About Maternity Coverage: Explicitly ask about maternity coverage within your insurance plan. Inquire about the extent of coverage for prenatal visits, which may include routine check-ups, ultrasounds, and screenings. Be sure to understand any co-payments, deductibles, or co-insurance that may apply to these services.

- Clarify Coverage for Delivery: Discuss the coverage for the actual delivery, whether it’s a vaginal birth or a Cesarean section. Understand the costs associated with hospital stays, anesthesia, and any other related services. Additionally, confirm that the hospital/birthing center is in network (or understand your out of pocket cost if not).

- Explore Postnatal Care Provisions: Extend the conversation to postnatal care, encompassing services after childbirth. This may include follow-up appointments, medications, and any necessary postpartum treatments.

- Check for Additional Benefits: Inquire about any additional benefits or support programs offered by your insurance provider for expectant mothers. Some plans may include resources such as lactation consulting (which even if you don’t think you need it, I promise it’s a great resource), well-baby check-ups, or postpartum mental health services. Keep in mind that if you don’t have coverage for something like a postpartum mental health visit, you may be covered for regular mental health visits that DON’T fall under maternal care.

- Review Policy Documents: Request and thoroughly review your insurance policy documents. Policies can be complex, but they contain detailed information about coverage limitations, exclusions, and any specific conditions that may apply to maternity care. Understanding the policy language will empower you to make informed decisions.

- Keep a Record of Communication: Document the details of your conversation with the insurance representative. Note down the names of the individuals you spoke with, the date of the conversation, and a summary of any important information.

Sometimes there are little “perks” that they’ll forget to mention unless you ask. When my second child was born, we learned that our insurance actually covered a free meal for my partner on the night of my daughter’s birth. We hadn’t known about this with my first child and so missed out on it. Not a big deal, but it was nice to have the second time around (don’t we all appreciate free stuff?)

Related: Newborn Baby Item Checklist

Related: How to Survive the First Week With a Newborn

In addition to contacting the insurance provider directly, online portals and mobile apps often offer accessible and detailed information about your coverage (which is great if you hate talking on the phone). Typically you can log in to your insurance account to review policy documents and claims history.

The last thing I’ll say is..while your medical provider can be a great advocate and spokesperson between you and your insurance, ALWAYS verify for yourself on whether this or that is covered. We had a provider who swore up and down that they took our insurance on multiple occasions. Rather than check for ourselves, we trusted this and ended up getting footed with thousands of dollars in medical expenses that would have been free under a covered provider.

In summary, researching and understanding insurance coverage involves proactive communication with your insurance provider, a thorough review of policy documents, and exploration of online resources. By taking these steps, first-time moms can gain clarity on their coverage, anticipate potential expenses, and better prepare for the financial aspects of welcoming a new member to the family.

Leave a Reply